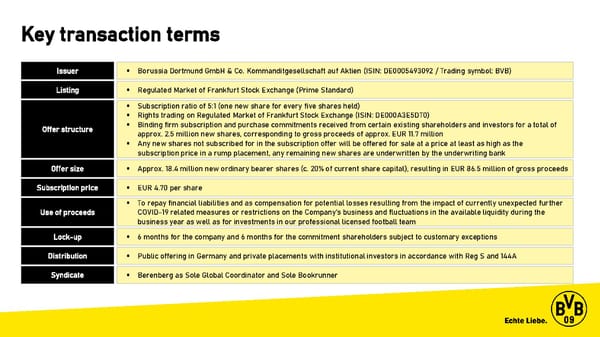

Key transaction terms Issuer ▪ Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien (ISIN: DE0005493092 / Trading symbol: BVB) Listing ▪ Regulated Market of Frankfurt Stock Exchange (Prime Standard) ▪ Subscription ratio of 5:1 (one new share for every five shares held) ▪ Rights trading on Regulated Market of Frankfurt Stock Exchange (ISIN: DE000A3E5DT0) Offer structure ▪ Binding firm subscription and purchase commitments received from certain existing shareholders and investors for a total of approx. 2.5 million new shares, corresponding to gross proceeds of approx. EUR 11.7 million ▪ Any new shares not subscribed for in the subscription offer will be offered for sale at a price at least as high as the subscription price in a rump placement, any remaining new shares are underwritten by the underwriting bank Offer size ▪ Approx. 18.4 million new ordinary bearer shares (c. 20% of current share capital), resulting in EUR 86.5 million of gross proceeds Subscription price ▪ EUR 4.70 per share ▪ To repay financial liabilities and as compensation for potential losses resulting from the impact of currently unexpected further Use of proceeds COVID-19 related measures or restrictions on the Company’s business and fluctuations in the available liquidity during the business year as well as for investments in our professional licensed football team Lock-up ▪ 6 months for the company and 6 months for the commitment shareholders subject to customary exceptions Distribution ▪ Public offering in Germany and private placements with institutional investors in accordance with Reg S and 144A Syndicate ▪ Berenberg as Sole Global Coordinator and Sole Bookrunner

Dortmund Football Club Presentation Page 2 Page 4

Dortmund Football Club Presentation Page 2 Page 4