Dortmund Football Club Presentation

Borussia Dortmund is a German professional sports club based in Dortmund, North Rhine-Westphalia. It is best known for its men's professional football team, which plays in the Bundesliga, the top tier of the German football league system. The club have won eight league championships, five DFB-Pokals, one UEFA Champions League, one Intercontinental Cup, and one UEFA Cup Winners' Cup.

Disclaimer Important Notice This document has been prepared by Borussia Dortmund GmbH & Co. KGaA ("Company") and is strictly confidential. All material contained in this document and information presented is for information purposes only and must not be relied upon for any purpose, and does not purport to be a full or complete description of the Company or its business. This document does not, and is not intended to, constitute or form part of, and should not be construed as, an offer to sell, or a solicitation of an offer to purchase, subscribe for or otherwise acquire, any securities of the Company, nor shall it or any part of it form the basis of or be relied upon in connection with or act as any inducement or recommendation to enter into any contract or commitment or investment decision whatsoever. This document is not directed at, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. Accordingly, the document may not be reproduced, redistributed, published or passed on, directly or indirectly, to any person in the United States of America ("United States"), Australia, Canada, Japan or any other jurisdiction, in each case where to do so would constitute a violation of the relevant laws of such jurisdiction. Persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. The information contained in this document does not purport to be comprehensive. None of the Company nor Joh. Berenberg, Gossler & Co. KG ("Bank") nor any of their respective subsidiary undertakings or affiliates nor their respective directors, officers, employees, advisers or agents, accepts any responsibility or liability whatsoever for, or makes any representation or warranty, express or implied, as to the truth, fullness, accuracy or completeness of the information in this document (or whether any information has been omitted from thepresentation) or any other information relating to the Company, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted ormade available or for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith. By accepting this document you acknowledge the foregoing and that you will be solely responsible for your own assessment of the Company, the industry and the market position of the Company and that you will conductyourownanalysisandbesolely responsible for forming your ownviewofthecurrentand potentialfutureperformanceofthe Company'sbusiness.Allinformation in this documentis subjecttoverification, correction, completion,updating andchangewithout notice. Neither the Company nor the Bank undertake any obligation to provide the recipient with access to any additional information nor to update this document nor any information nor to correct any inaccuracies in any such information A significant portion of the information contained in this document, including market data and trend information, is based on estimates or expectations of the Company, and there can be no assurance that these estimates or expectations are or will prove to be accurate. Where any information and statistics are quotedfromanyexternalsource,suchinformationorstatistics should notbe interpreted as having beenadopted or endorsed by the Company as being accurate. All statements in this report attributable to third party industry experts represent the Company's interpretation of data, research opinion or viewpoints published by such industry experts, and have not been reviewed by them. Each publication of such industry experts speaks as of its original publication date and not as of the date of this document. This document contains forward-looking statements relating to the business, financial performance and results of the Company or the industry in which the Company operates. These statements may be identified by words such as "expectation", "belief", "estimate", "plan", "target" or "forecast" and similar expressions, or by their context. Forward-looking statements include statements regarding: strategies, outlook and growth prospects; future plans and potential for future growth; growth for products and services in new markets; industry trends; and the impact of regulatory initiatives. These statements are made on the basis of current knowledge and assumptions and involve risks and uncertainties. Various factors could cause actual future results, performance or events to differ materially from those described in these statements,and neither the Company nor any other person accepts any responsibility for the accuracy of the opinions expressed in this document or the underlying assumptions.No obligation is assumed toupdate any forward-looking statements. Theinformation contained in this document does not purport to be comprehensive and has not been subject to any independent audit or review. Certain of the financial information as of and for the years ended 30 June 2019, 2020 and 2021 has been derived from audited financial statements and should be read in conjunction with the relevant audited financial statements,including the notes thereto. Certain financial data included in the document consists of "non-GAAP financial measures". These non-GAAP financial measures may not be comparable tosimilarly titled measures presented by other companies,nor should they be construed as an alternative to other financial measures determined in accordance with German GAAP. You are cautionednot toplace undue reliance on any non-GAAP financial measures and ratios included herein. This documentandanymaterialsdistributed in connectionwiththis documentare not directedto, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in Australia, Canada, Japan,or the United States. The securities described herein have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended ("Securities Act"), and may not be offered or sold in or into the United States, except pursuant to an exemption from the registration requirement of the Securities Act. Within the European Economic Area, this document is being made, and is directed only, to persons who are "qualified investors" within the meaning of Article 2(e) of the Prospectus Regulation (Regulation (EU) 2017/1129, as amended). This document is for information purposesonly and does not constitute an offering document or an offer of securities to the public in the United Kingdom to which section 85 ofthe Financial Services and Markets Act 2000 of the United Kingdom (as amended by the Financial Services Act 2012 of the United Kingdom) applies. It is not intended to provide the basis for any evaluation of any securities and should not be considered as a recommendation that any person should subscribe for or purchase any securities. In the United Kingdom, this document is being made, and is directed only, to persons who are both (i) “qualified investors” within the meaning of Article 2(e) of the Prospectus Regulation (Regulation (EU) 2017/1129, as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 and either (ii) persons falling within the definition of Investment Professionals (contained in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order")) or other persons to whom it may lawfully be communicated in accordance with the Order; or (iii) high net worth bodies corporate, unincorporated associations and partnerships and the trustees of high value trusts, as described in Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "Relevant Persons"). Any investment or investment activity to whichthis documentrelates in available only toRelevant Persons and will be engaged in only with Relevant Persons. Byattending this documentand/or accepting or reading a copy of this document,you agree tobe boundby the foregoing limitations and conditions.

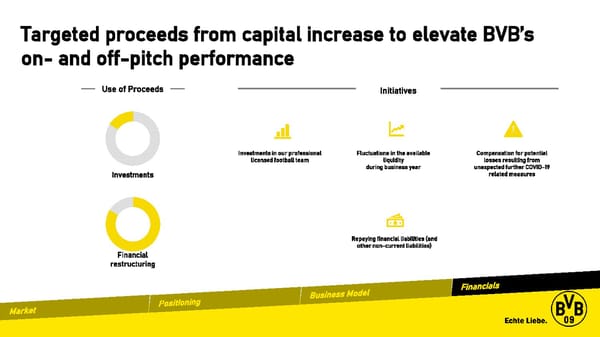

Key transaction terms Issuer ▪ Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien (ISIN: DE0005493092 / Trading symbol: BVB) Listing ▪ Regulated Market of Frankfurt Stock Exchange (Prime Standard) ▪ Subscription ratio of 5:1 (one new share for every five shares held) ▪ Rights trading on Regulated Market of Frankfurt Stock Exchange (ISIN: DE000A3E5DT0) Offer structure ▪ Binding firm subscription and purchase commitments received from certain existing shareholders and investors for a total of approx. 2.5 million new shares, corresponding to gross proceeds of approx. EUR 11.7 million ▪ Any new shares not subscribed for in the subscription offer will be offered for sale at a price at least as high as the subscription price in a rump placement, any remaining new shares are underwritten by the underwriting bank Offer size ▪ Approx. 18.4 million new ordinary bearer shares (c. 20% of current share capital), resulting in EUR 86.5 million of gross proceeds Subscription price ▪ EUR 4.70 per share ▪ To repay financial liabilities and as compensation for potential losses resulting from the impact of currently unexpected further Use of proceeds COVID-19 related measures or restrictions on the Company’s business and fluctuations in the available liquidity during the business year as well as for investments in our professional licensed football team Lock-up ▪ 6 months for the company and 6 months for the commitment shareholders subject to customary exceptions Distribution ▪ Public offering in Germany and private placements with institutional investors in accordance with Reg S and 144A Syndicate ▪ Berenberg as Sole Global Coordinator and Sole Bookrunner

Transaction timeline 16 September 2021 ▪ Prospectus approval and publication 17 September 2021 ▪ Publication of the subscription offer in the German Federal Gazette (Bundesanzeiger) ▪ Ex-date; shares trade without subscription rights 20 September 2021 ▪ Start of subscription period ▪ Start of management roadshow 21 September 2021 ▪ Start of rights trading 30 September 2021 ▪ End of rights trading 4 October 2021 ▪ End of subscription period ▪ End of management roadshow 5 October 2021 ▪ Rump placement (if any) ▪ Publication of the final results of the offer on the company’s website 7 October 2021 ▪ Admission of new shares to trading on the Regulated Market of the Frankfurt Stock Exchange (Prime Standard) 8 October 2021 ▪ Start of trading of new shares ▪ Settlement and closing

Our management 16 16 10 14 HANS-JOACHIM WATZKE THOMAS TREß CARSTEN CRAMER DR. ROBIN STEDEN CEO CFO CMO HEAD OF IR & LEGAL COUNSEL Number of years with Borussia Dortmund

Introduction of Borussia Dortmund

Borussia Dortmund is one of the most successful football clubs in the world BORUSSIA DORTMUND’s Bundesliga ranking 1 1 2 2 2 2 2 3 4 3 5 6 7 Champions Covid-19 impact League Final 536 120 117 376 406 370 370 24 Total group revenue (EURm)(1) 305 334 261 276 215 115 110 151 (3) 2008/09A 2009/10A 2010/11A 2011/12A 2012/13A 2013/14A 2014/15A 2015/16A 2016/17A 2017/18A 2018/19A 2019/20A 2020/21A Total group revenue Transfer proceeds IFRIC revenue adjustments(2)

Europe’s largest standing area, making the best fans in the world to the unique and notorious “yellow wall” A global brand with a global following 42.2m Rank #14 Total followers In European total reach THE 15.2m 15.5m Facebook followers Instagram followers “SÜDTRIBÜNE” 1.0m 152,000 Registered users club members worldwide

BVB at a glance 8 5 24.8yrs Average age German championships Cup victories of the current team(1) 1965, 1989, 2012, 2017, 2021 1956, 1957, 1963, 1995, 1996, 2002, 2011, 2012 EUR 359m EUR 632m EUR 334m Consolidated total Market capitalization(2) Total group revenues operating proceeds

Key investment highlights 1 2 3 4 Attractive Positioned in the sweet Strong business model Highly attractive football industry spot of a globalising pillars with promising financial profile dynamics football market upside potential Achievements: 8x 6x 5x 1x 1x 1x

Market – Football industry dynamics

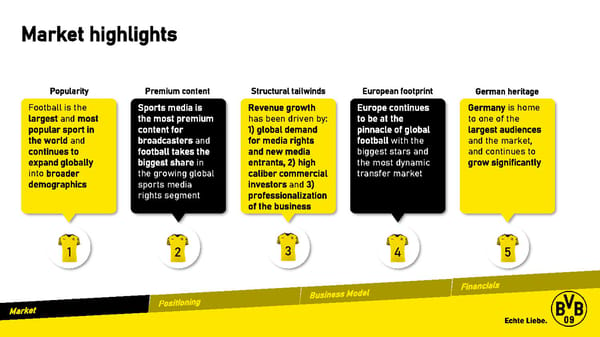

Market highlights Popularity Premium content Structural tailwinds European footprint German heritage Football is the Sports media is Revenue growth Europe continues Germany is home largest and most the most premium has been driven by: to be at the to one of the popular sport in content for 1) global demand pinnacle of global largest audiences the world and broadcasters and for media rights football with the and the market, continues to football takes the and new media biggest stars and and continues to expand globally biggest share in entrants, 2) high the most dynamic grow significantly into broader the growing global caliber commercial transfer market demographics sports media investors and 3) rights segment professionalization of the business 1 2 3 4 5

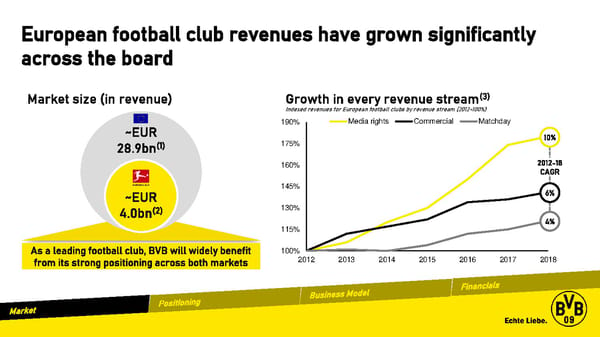

European football club revenues have grown significantly across the board Market size (in revenue) Growth in every revenue stream(3) Indexed revenues for European football clubs by revenue stream (2012=100%) 190% Media rights Commercial Matchday ~EUR 10% 28.9bn(1) 175% 160% 2012-18 CAGR 145% 6% ~EUR 4.0bn(2) 130% 115% 4% As a leading football club, BVB will widely benefit 100% from its strong positioning across both markets 2012 2013 2014 2015 2016 2017 2018

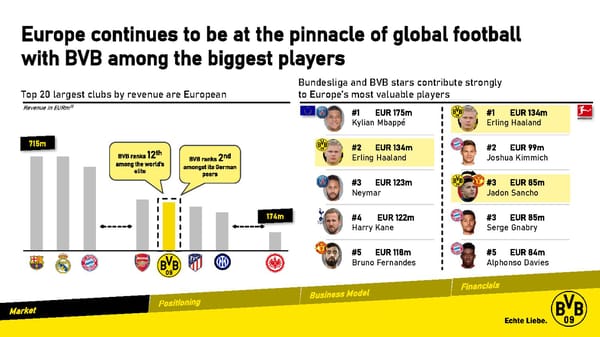

Europe continues to be at the pinnacle of global football with BVB among the biggest players Bundesliga and BVB stars contribute strongly Top 20 largest clubs by revenue are European to Europe’s most valuable players Revenue in EURm(1) #1 EUR 175m #1 EUR 134m Kylian Mbappé Erling Haaland 715m #2 EUR 134m #2 EUR 99m BVB ranks 12th BVB ranks 2nd Erling Haaland Joshua Kimmich among the world's amongst its German elite peers #3 EUR 123m #3 EUR 85m Neymar Jadon Sancho 174m #4 EUR 122m #3 EUR 85m Harry Kane Serge Gnabry #5 EUR 118m #5 EUR 84m Bruno Fernandes Alphonso Davies

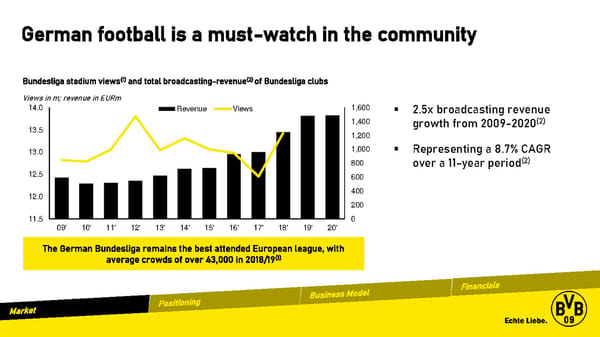

German football is a must-watch in the community (1) (2) Bundesliga stadium views and total broadcasting-revenue of Bundesliga clubs Views in m; revenue in EURm 14.0 Revenue Views 1,600 ▪ 2.5x broadcasting revenue 1,400 growth from 2009-2020(2) 13.5 1,200 13.0 1,000 ▪ Representing a 8.7% CAGR 800 over a 11-year period(2) 12.5 600 12.0 400 200 11.5 0 09' 10' 11' 12' 13' 14' 15' 16' 17' 18' 19' 20' The German Bundesliga remains the best attended European league, with average crowds of over 43,000 in 2018/19(1)

German football can reach international markets Country EUR 3.4bn Broadcasting EUR 2.0bn revenue (2020-21) EUR 1.4bn EUR 1.3bn EUR 1.2bn % international 45.6% 43.8% 19.4% 27.6% 6.5% share(1) The German Bundesliga still faces an untapped potential in its international market penetration: current international share only 19.4%, opposed to the Premier League’s and LaLiga’s 45.6% and 43.8% international share, respectively

New participants entering the market will accelerate the structural shift in demand and professionalisation New player in non-traditional content … alongside increasingly high caliber entering the market… investors CVC Capital and Advent International acquire a 10% The Friedkin Group announced the acquisition of an stake in a new Serie A media unit(1) 86.6% stake in A.S. Roma and that it will launch a Nov Aug LaLiga has agreed to a EUR 2.7bn deal in which CVC Capital Aug mandatory tender offer upon the publicly held 2020 2021 Partners will hold a 10% stake in its operating business 2020 ordinary shares DAZN obtained the rights to 106 Bundesliga matches US private equity giant Silver Lake invested USD 500m for each of four seasons starting 2021/22 in city Football Group, owner of Manchester City Jun Aug DAZN secured exclusive German rights to 121 UEFA Champions Nov amongst other clubs 2020 2020 league matches for each of three seasons starting 2021/22 2019 Amazon acquired exclusive German rights to 16 Champions Elliott Management, an American hedge fund that had League matches a season for three seasons starting 2021/22 previously provided a loan of EUR 300m, assumed Dec Jun Amazon also obtained the right to show 20 Premier League Jul control of AC Milan in July 2019 2018 matches for each of three seasons starting in 2018/19 2018 Facebook secured exclusive rights to 32 UEFA Champions League matches for three seasons starting 2017/18 Chinese retail giant Suning acquired a majority stake Aug Oct Facebook also secured rights to 46 (27 exclusively) Copa Jun in Inter Milan 2018 2018 Libertadores matches for each of three seasons starting ‘18/19 2016

Positioning – The sweet spot of European football

A unique club with 111+ years of heritage 1x Champions League Winner 8x German Champion 5x German Cup Winner 1x European Cup Winner

Borussia Dortmund positioned in the sweetspot of a globalising football market “Global brands” ▪ Focus on monetisation of commercial brands ▪ Significant ongoing transfer investments required to maintain squad level at top of key European leagues ▪ Limited profitability and cash flow generation (negative transfer profit) “Sweet Spot” ▪ Dominant / incubent position in the top league competitions outside the ‘Big 5‘ with yearly presence on the European stage ▪ Greater focus on sourcing high-potential players from lower-tier clubs, player development and selling players at significant premiums “Local brands” ▪ Less certain access to key European competitors and limited UEFA revenues ▪ Some player transfer profit Attractive and consistent financial returns through “Sweet Spot“ positioning

Borussia Dortmund is one of the eldest and most decorated football clubs in Europe BVB has a strong heritage … Founding year: 1900 1902 1905 1908 1909 1919 1927 1945 1950 1970 2005 2009 2013 … and is one of the most decorated clubs in Europe 8x 6x 5x 1x 1x 1x German champion German DFB-Cup winner World club cup European cup Champions league of Bundesliga Supercupwinner champion winner winner

The Game - The business model for success

A virtuous cycle of success Leading position in German league facilitates consistent access …drives larger revenue potential… to European competitions… ▪ High probability of UCL participation ▪ Material portion of revenue linked to participation, with − Top 4 Bundesliga teams have a guaranteed place in further upside the UCL group stage ▪ BVB received a total pay-out by UEFA Champions League − #5 goes to the third qualifying round of the UCL of EUR 78.7m in 2020/21 (EUR 67.4m in 2019/20) …maximizing ability to retain and develop players… …and a “shop-window” to entice young talent… ▪ Data-driven and professionalized talent recruitment ▪ Ultimate showcase, attracting global young talent process − European competition exposure serves as the perfect ▪ Highly successful academy with at least two youth “scouting” ground for the ‘Big 5’ league clubs players ready to play in the first team every season − Greater ability to compete for titles and individual ▪ Individual development programmes prizes in the domestic league ▪ Ability to obtain and reacquire players

Business model pillars 01 02 03 Sporting High Brands/ success potentials fans Merchan- Match TV Marketing Advertising dising/ Transfer operations conference deals and catering

Sporting Borussia Dortmund’s sporting ambitions and success Success Sporting ambitions 1 2 Champions 3 4 5 Bundesliga league Player Remaining Entertaining success qualification development competitive football Approach to achieve these ambitions Excellent staff and Gradual process though Retaining talent best practices continuity Investment in young Signing high-quality players players

High Junior talent concept approach – intensifying the Potentials promotion of up-and-coming talent Player offering ▪ Developing junior talent into a strong professional team that will play on a Professional global stage Professional ▪ Borussia Dortmund offers its young players a competitive salary Development Phase Player development ▪ Modern training centre and the “BVB Academy” provides for Youth Development excellent training conditions Phase ▪ BVB trained around 100 former junior players who have made the leap into professional football Foundation Phase Player scouting ▪ Borussia Dortmund uses a worldwide scouting network U9 – U11 U12 – U13 with about 30 scouts all around the world Development ▪ Ultra-modern IT systems support the scouts in their work Level I/E and enable them to conduct individual player analyses

High Proprietary sports technology focused on improving Potentials performance of high potentials 1 Data collection 2 Data analytics 3 Data application ▪ Integrated database of player progress ▪ Multiple data sources provide an in- ▪ Individual and adaptive training schedule and statistics depth analysis with the help of latest ▪ World class training facilities ▪ Players are tracked throughout on a daily scientific advances ▪ Specialists provide full nutritional and basis recovery support

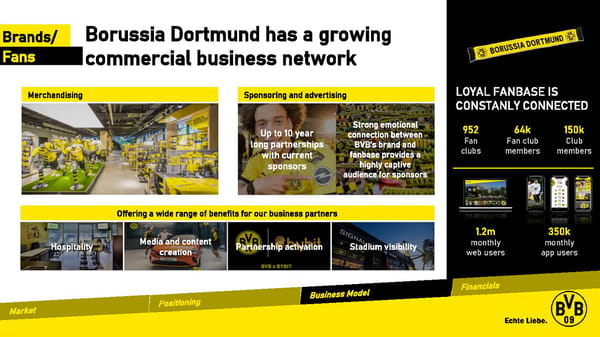

Input to be discussed Borussia Dortmund has a growing e.g. sponsors Brands/ Fans commercial business network Merchandising Sponsoring and advertising LOYAL FANBASE IS CONSTANLY CONNECTED Strong emotional 952 64k 150k Up to 10 year connection between Fan Fan club Club long partnerships BVB’s brand and clubs members members with current fanbase provides a sponsors highly captive audience for sponsors Offering a wide range of benefits for our business partners 1.2m 350k Hospitality Media and content Partnership activation Stadium visibility monthly monthly creation web users app users

Brands/ Sponsorship targets have been Fans set for the coming years Main Partners BVB Champion Partner BVB Premium Partner BVB Partner

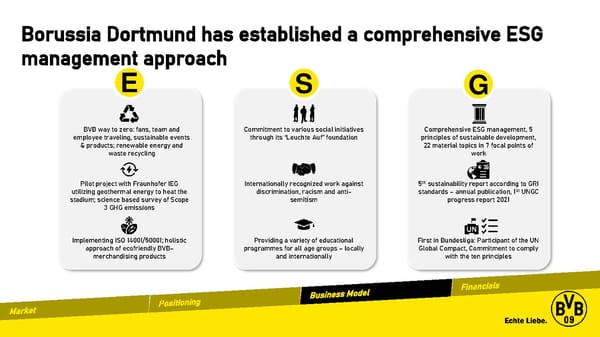

Borussia Dortmund has established a comprehensive ESG management approach E S G BVB way to zero: fans, team and Commitment to various social initiatives Comprehensive ESG management, 5 employee traveling, sustainable events through its “Leuchte Auf” foundation principles of sustainable development, & products; renewable energy and 22 material topics in 7 focal points of waste recycling work th Pilot project with Fraunhofer IEG Internationally recognized work against 5 sustainability report according to GRI utilizing geothermal energy to heat the discrimination, racism and anti- standards – annual publication, 1st UNGC stadium; science based survey of Scope semitism progress report 2021 3 GHG emissions Implementing ISO 14001/50001; holistic Providing a variety of educational First in Bundesliga: Participant of the UN approach of ecofriendly BVB- programmes for all age groups – locally Global Compact, Commitment to comply merchandising products and internationally with the ten principles

Highly diversified income streams In the future, the core business will re- Merchan- main professional football Match TV Marketing Advertising dising/ Transfer with its classic pillars of operations conference deals income: Games, TV and catering marketing, advertising, retail, and transfers. These goals serve as the basis for the management of the company.

Match Operations in Germany‘s largest Operations stadium Almost 100% stadium capacity utilization 55,000season tickets sold Stable revenues Revenuein EURm 43.9 42.3 44.7 Covid-19 impact Key revenue streams 32.5 Tickets Food & Beverage Hospitality Of which With Capacity of c. 55,000 EUR 6.77 4,088 0.6 (3) Season tickets – Average revenue per seats lead to revenue of 2016/17A 2017/18A 2018/19A 2019/20A 2020/21A (1, 2) (2) ØEUR c. 360 ticket sold EUR c. 21m

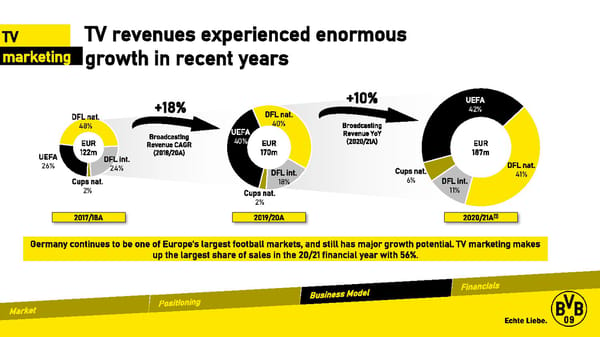

TV TV revenues experienced enormous marketing growth in recent years +10% UEFA +18% DFL nat. 42% DFL nat. 40% 48% UEFA Broadcasting Broadcasting Revenue YoY EUR Revenue CAGR 40% EUR (2020/21A) EUR UEFA 122m DFL int. (2018/20A) 170m 187m 26% 24% Cups nat. DFL nat. DFL int. 41% Cups nat. 18% 6% DFL int. 2% Cups nat. 11% 2% 2017/18A 2019/20A 2020/21A(1) Germany continues to be one of Europe’s largest football markets, and still has major growth potential. TV marketing makes up the largest share of sales in the 20/21 financial year with 56%.

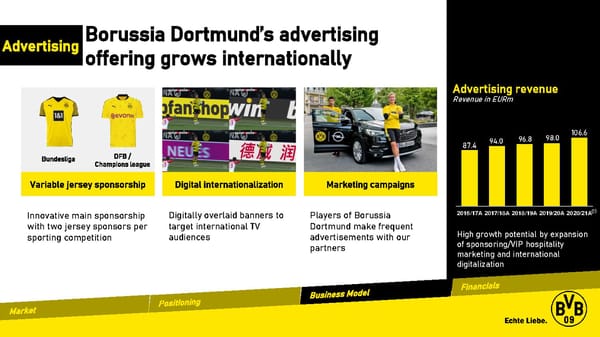

Advertising Borussia Dortmund’s advertising offering grows internationally Advertising revenue Revenuein EURm 96.8 98.0 106.6 87.4 94.0 Bundesliga DFB / Champions league Variable jersey sponsorship Digital internationalization Marketing campaigns (1) Innovative main sponsorship Digitally overlaid banners to Players of Borussia 2016/17A 2017/18A 2018/19A 2019/20A 2020/21A with two jersey sponsors per target international TV Dortmund make frequent High growth potential by expansion sporting competition audiences advertisements with our of sponsoring/VIP hospitality partners marketing and international digitalization

Merchandising Non-matchday operations offer Conference & catering upside for Borussia Dortmund 2 Merchandising/ conference 2,000m and catering revenue 154,000 Revenuein EURm Covid-19 7 Flagship store impact Merchandise Jersey Sales(1) 72.0 69.8 Stores 57.8 61.4 40.4 119,388 (2) Conference & 744 2016/17A 2017/18A 2018/19A 2019/20A 2020/21A Catering Events Visitors stadium tour

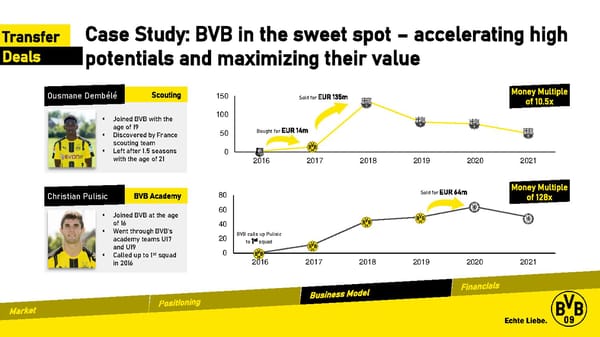

Transfer Transfer deals: proven track record of realizing strong Deals returns on players Players Initial Value Years at BVB Selling Price ROI Multiple Transfer Club Player ? ? ? ? Jadon Sancho EUR 8m 4 EUR 85m 10.9x Ousmane Dembélé EUR 14m 1.5 EUR 135m 10.5x Christian Pulisic EUR 0.5m 4 EUR 64m 128x Pierre – Emerick EUR 15m 4 EUR 64m 4.3x Aubameyang Henrikh Mkhitaryan EUR 28m 3 EUR 42m 1.5x Mario Götze EUR 0.5m 7 EUR 37m 74x

Transfer Case Study: BVB in the sweet spot – accelerating high Deals potentials and maximizing their value Ousmane Dembélé Scouting 150 Sold for EUR 135m Money Multiple of 10.5x ▪ Joined BVB with the 100 age of 19 50 Bought for EUR 14m ▪ Discovered by France scouting team ▪ Left after 1.5 seasons 0 with the age of 21 2016 2017 2018 2019 2020 2021 80 Sold for EUR 64m Money Multiple Christian Pulisic BVB Academy of 128x ▪ Joined BVB at the age 60 of 16 40 ▪ Went through BVB’s 20 BVB calls up Pulisic academy teams U17 to 1st squad and U19 st 0 ▪ Called up to 1 squad 2016 2017 2018 2019 2020 2021 in 2016

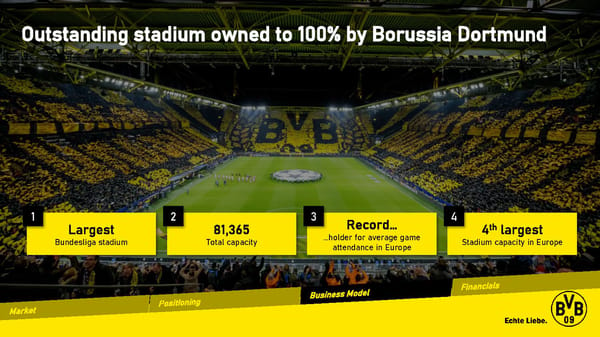

Outstanding stadium owned to 100% by Borussia Dortmund 1 2 3 4 Largest 81,365 Record… 4th largest Bundesliga stadium Total capacity …holder for average game Stadium capacity in Europe attendance in Europe

The 2021/22 Line-Up Market capitalization of (2) EUR 632.0m Team value of (1) EUR 598.1m

Financials

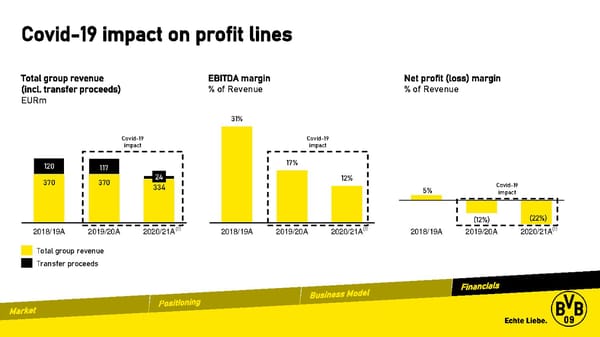

Covid-19 impact on profit lines Total group revenue EBITDA margin Net profit (loss) margin (incl. transfer proceeds) % of Revenue % of Revenue EURm 31% Covid-19 Covid-19 impact impact 120 117 17% 370 370 24 12% 334 5% Covid-19 impact (12%) (22%) (1) (1) (1) 2018/19A 2019/20A 2020/21A 2018/19A 2019/20A 2020/21A 2018/19A 2019/20A 2020/21A Total group revenue Transfer proceeds

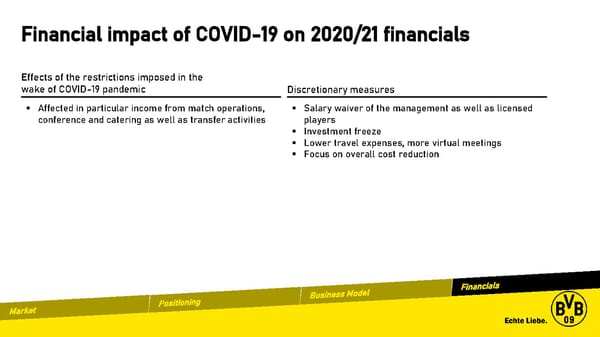

Financial impact of COVID-19 on 2020/21 financials Effects of the restrictions imposed in the wake of COVID-19 pandemic Discretionary measures ▪ Affected in particular income from match operations, ▪ Salary waiver of the management as well as licensed conference and catering as well as transfer activities players ▪ Investment freeze ▪ Lower travel expenses, more virtual meetings ▪ Focus on overall cost reduction

Targeted proceeds from capital increase to elevate BVB’s on-and off-pitch performance Use of Proceeds Initiatives ~[…]m Investment Programme Investments in our professional Fluctuationsin the available Compensationfor potential licensed football team liquidity losses resulting from during business year unexpected further COVID-19 Investments related measures Repaying financial liabilities (and other non-current liabilities) Financial restructuring

Appendix

A club with global presence and a local foothold 3 Offices on multiple continents >30 Countries have a strong BVB fan connection Offices in Dortmund, Shanghai and 30,000 Singapore with administrative, Children coached globally scouting and coaching activities Presence through global competitions like UEFA Champions league, ICC Cup and local partnerships

BORUSSIA DORTMUND INTRODUCTION Borussia Dortmund group BORUSSIA DORTMUND GMBH & CO. KGAA 100% 33.33% BVB Stadionma- BVB Merchan- BVB Event & Besttravel BVB Fußball- BVB Asia Pacific Orthomed GmbH nagementGmbH dising GmbH Catering GmbH Dortmund GmbH akademie GmbH Pte. Ltd. 66.67% Consolidated tax group Orthomed Management

BORUSSIA DORTMUND INTRODUCTION Organisation of Management and Control BALLSPIELVEREIN BORUSSIA 09 E.V. DORTMUND BORRUSIA DORTMUND GESCHÄFTSFÜHRUNGS-GMBH GENERAL PARTNER Chairman Council of Economic Affairs elects appoints elects Advisory Board Managing Directors Member’s Meeting appoints and monitors Consisting of members of the No right of appointment, BORUSSIA DORTMUND GMBH & CO. KGAA Executive Board and Council of only right of supervision Economic Affairs and non- voting, associated members Supervisory Board elects Annual General Meeting

FUTURE VIABILITY OF BUNDESLIGA APPENDIX SOURCE-BASED ALLO- 50 + 1 FINANCIAL FAIR PLAY CATION OF TV FUNDS Increasing fan base Protection from pursuit of individual Fair financial competition regardless and loyalty interests which are not economical of ownership structures (selfishness and vanity) Greater focus of club executives on Protection from accumulation of Promotion of reasonable financial increasing the brand value excessive debt by clubs measures taken by clubs Increasing the attractiveness Maintaining and Maintaining and improving of the Bundesliga – improving sovereignty financial stability in the nationally and internationally of the Bundesliga clubs Bundesliga

UPDATE ON RECENT EVENTS From mid-March 2020, the Company’s income and earnings were shaped by the severe restrictions on public life imposed in response to the COVID-19 pandemic and the massive impact this has had on the economy. Still the pandemic is there but with the return of up to 25.000 spectators to the first Bundesliga home match of the season 2021/2022 in the iconic SIGNAL IDUNA PARK a first step of recovery has been made. After years of continuity in Borussia Dortmund’s Most sympathetic football club in Germany dividend policy, still no dividend payment for (Statista & SPORTFIVE Survey 02.08.2021) 2020/2021 fiscal year will be proposed to the Annual General Meeting due to the net loss for the year caused by the Covid-19 crisis. Decade long participation in UEFA competitions. Successful incoming transfers of Donyell Malen and Gregor Kobel.

BVB SHARE APPENDIX • Research report by Hauck & Aufhäuser Privatbankiers AG, dated 26 August 2021 issued “Buy” • Research report by Berenberg, Hamburg, dated 18 August 2021 issued “Buy” recommendation (previously: “Buy”) • Research report by Edison Investment Research Ltd., London (UK), dated 17 August 2021, recommendation: “n/a” • Research report by Frankfurt Main Research AG, Frankfurt a. M., dated 17 August 2021 issued “Buy” recommendation (previously: “Buy”) • Research report by Stifel Europe Bank AG, Frankfurt a. M, dated 10 May 2021 issued “Hold” recommendation (previously: “Hold”) • Research report by GSC Research GmbH, Düsseldorf, dated 16 November 2020 issued “Buy” recommendation (previously: “n/a”) Further information available for download under “Capital Market View” at our IR page at www.bvb.de/aktie.

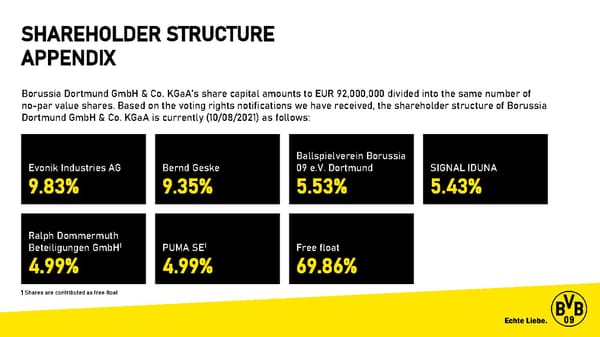

SHAREHOLDER STRUCTURE APPENDIX Borussia Dortmund GmbH & Co. KGaA’s share capital amounts to EUR 92,000,000 divided into the same number of no-par value shares. Based on the voting rights notifications we have received, the shareholder structure of Borussia Dortmund GmbH & Co. KGaA is currently (10/08/2021) as follows: Ballspielverein Borussia Evonik Industries AG Bernd Geske 09 e.V. Dortmund SIGNAL IDUNA 9.83% 9.35% 5.53% 5.43% Ralph Dommermuth Beteiligungen GmbH1 PUMA SE1 Free float 4.99% 4.99% 69.86% 1 Shares are contributed as free float

FINANCIAL CALENDAR APPENDIX 02/09/2021 28/09/2021 14/05/2021 Stockpicker Summit, Sweden Disclosure Annual Report Disclosure Q3 Financial Report Company presentation 2020/2021 2020/2021 06 – 08/09/2021 12/11/2021 18/08/2021 Berenberg Virtual Roadshow Disclosure Q1 Financial Report Berenberg virtual Roadshow, USA Company presentation 2021/2022 Company presentation

IR CONTACT DETAILS APPENDIX Borussia Dortmund GmbH & Co. KGaA Dr. jur. Robin STEDEN Rheinlanddamm207 –209 44137 Dortmund Germany Tel: +49 (0) 231 9020-2746 Fax: +49 (0) 231 9020-852746 E-mail: [email protected] www.bvb.de/aktie

Partners BVB ChampionPrartner BVB PremiumPartner BVB Partner BVB RegionalParner